Google Launches A New Tool To Sell Car Insurance To U.S Web Searchers

Google Launches A New Tool To Sell Car Insurance To U.S Web Searchers

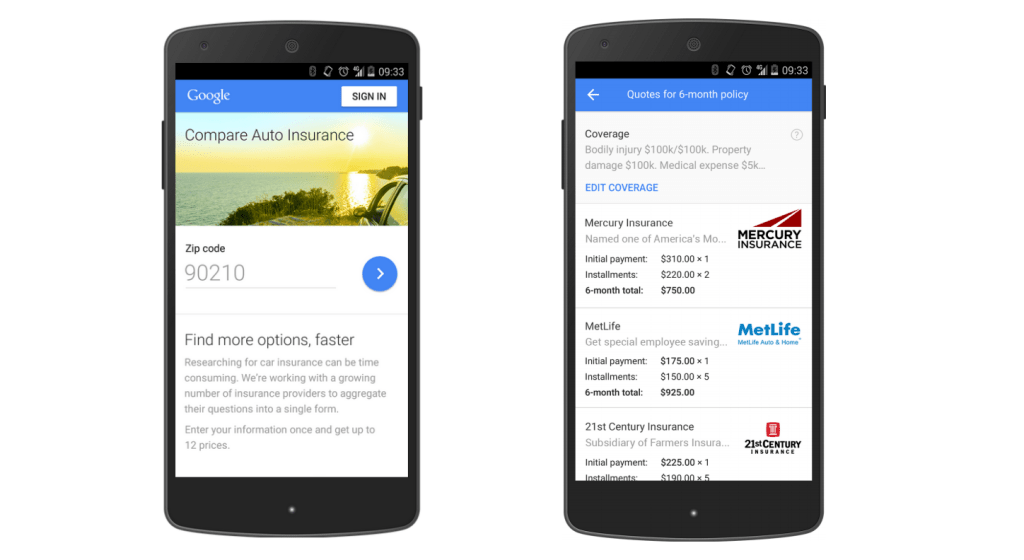

Confirming earlier reports

that Google has been plotting a move to help sell consumers auto

insurance in the U.S., the search giant announced this morning it’s

launching a new feature called “Google Compare for Auto Insurance,”

a comparison-shopping site that lets you compare the rates from

different insurance providers. The option to compare rates will begin

popping up after a consumer does a Google search for “car insurance”

using Google’s search engine. Initially, the service is being made

available to California residents, but Google says other states will soon follow later this year.

Confirming earlier reports

that Google has been plotting a move to help sell consumers auto

insurance in the U.S., the search giant announced this morning it’s

launching a new feature called “Google Compare for Auto Insurance,”

a comparison-shopping site that lets you compare the rates from

different insurance providers. The option to compare rates will begin

popping up after a consumer does a Google search for “car insurance”

using Google’s search engine. Initially, the service is being made

available to California residents, but Google says other states will soon follow later this year.Consumers who enter in this search query will see a small, gray questionnaire appear, asking for their zip code, and other information about their vehicle. If they choose to fill that out, Google will return a comparison unit listing insurance premiums, provided by its insurance advertiser partners. Alternately, users can also go to www.google.com.com/compare to kick off the same experience and get quotes.

Google’s insurance partners, which include Mercury Insurance and MetLife, as well as local providers, is based on a flexible cost-per-acquisition (CPA) model, Google notes, adding that payment isn’t a factor in ranking or eligibility. The insurance providers can also use the service to highlight what makes them unique, as the Compare product has a field where they can mention their differentiating features – like safe driver discounts, or “A”-rated customer service, for example.

Today, Google already provides auto and travel insurance quotes, as well as mortgage quotes in the U.K., and it operates a credit card comparison site in the U.S., all of which fall under the “Google Compare” branding. However, recent job postings have hinted at Google looking to bring a similar mortgage comparison service to the U.S., and Forrester also said earlier this year that it expected Google would roll out a car insurance comparison service in Q1, beginning with California.

The auto comparison U.K. site has been live since 2012, but the U.S. launch has continually been pushed back. However, as of this January, Google Compare Auto Insurance Services, Inc. was licensed to do business in more than half of U.S. states, Forrester noted. The firm also found that Google was working with San Francisco-based car insurance comparison startup CoverHound, and speculated they had been acquired – a guess that CoverHound shot down soon after.

Google says that its comparison technology was built in-house, but did confirm it’s working with “many partners” including CoverHound and CompareNow as part of the quote aggregation process.

The move to offer insurance comparisons to web searchers could help Google generate additional revenue through commissions, but several of the major insurance carriers in the U.S. have been declining to work with Google on this new effort, we understand, including names like Progressive, State Farm, GEICO, and Allstate. (We asked Google if it would list its current partners, but the company declined. However, its website lists the logos of several providers including The General Insurance, 21st Century Insurance, Infinity, Kemper Speciality, Titan Insurance, Stillwater, CSE Insurance Group, and others.)

“Many of the major carriers are very resistant to participate on the Google Compare platform,” explains Joshua Dziabiak, a co-founder at car insurance comparison startup The Zebra. “Based off what they’ve built in the U.K., carriers see this as a price-only comparison…and they don’t want to be compared only on the price,” he says.

More Data For Google’s Self-Driving Car Biz?

It’s unclear how much revenue Google would generate from this auto insurance comparison site, as consumers may not be prepared to buy from an aggregator like this at present. But auto insurance companies write $175 billion in premiums for private passenger auto insurance yearly, and the typical insurance commission is somewhere around 10%. (Some of that may be shared with partners like CoverHound, however.)But for Google, the comparison site may not be just about an additional revenue stream – it could be about collecting more information on how the different insurance companies price the same risk. Google can use that information if it wants to underwrite auto insurance itself in the future.

“If you think about what’s going on with self-driving cars in the future, Google is really going to have to understand how insurance companies price risk because the whole model is going to change,” notes Forrester analyst Ellen Carney. “And I imagine that some component of insurance is going to be included with the car,” she adds.

Comments

Post a Comment